£100m of premium bond prizes remain unclaimed

4 hours agoAlex HomerBBC Shared Data Unit

Alamy

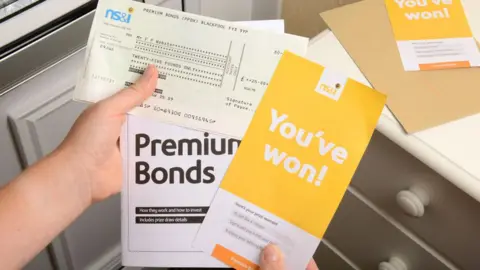

AlamyMore than £100m of premium bond prizes remain unclaimed amid criticism that the government-owned bank which operates the savings scheme is not doing enough to find the winners.

Among the 2.5 million unclaimed prizes are 11 winners of £100,000 – the second-largest prize available.

Critics say the process to trace accounts needs reform as it is too difficult for people gifted Premium Bonds, or those who only ever had paper records.

Operator National Savings and Investments (NS&I) said it had paid more than 99% of the prize-winners since starting its tax-free draws in 1957.

Wills and probate solicitor Patrice Lawrence said she had helped seven people trace accounts including clients, and friends and family.

“It’s shocking that a government-owned bank is sitting on nearly £100m [in unclaimed prizes] that doesn’t belong to it during a cost of living crisis,” she told the BBC.

Premium Bonds are a lottery-style, government-backed savings account where people can put money in and take it out when they want.

Instead of being paid interest, bondholders are given a monthly prize draw entry for each £1 invested. Some bondholders will receive nothing in a draw and others will win prizes from £25 all the way up to a £1m jackpot.

NS&I said every jackpot millionaire had received their money.

Fox Photos/Getty Images

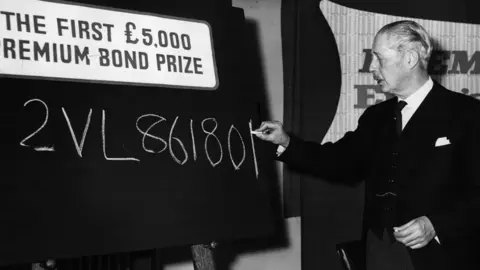

Fox Photos/Getty ImagesSince the first draw in June 1957, its Electronic Random Number Indicator Equipment – known as ERNIE – has drawn a total of 772 million prizes worth a combined £37bn.

Premium Bonds prize winners should receive notifications of their winnings via text message, email or post if they have registered their details.

Some customers, however, relocate and forget to update their details.

Other bond holdings are not registered. For example, people may be unaware they were gifted bonds as children, or they were never given the paper certificate carrying the account numbers.

NS&I retail director Andrew Westhead said the bank recognised bonds purchased before digitisation were “much harder to trace”.

Alamy

AlamyNearly 23 million people had Premium Bonds accounts worth a combined £130bn, as of the end of March 2025.

NS&I originally contacted winners by post and sent cheques, but since 2011 holders could choose to have prizes paid directly into a bank account or reinvested in more bonds.

The oldest unclaimed prize was £25 won in November 1957 in South Yorkshire.

Mr Westhead said: “The £103m of prizes currently unclaimed represents just 0.28% of the total £37bn awarded by ERNIE over nearly seven decades.”

He said the bank provided information online and through its call centre on how to claim winnings, publicised details of unclaimed prizes and encouraged customers to use its prize checker.

People can also use its tracing service to track down mislaid bonds, he said.

NS&I also said that, as of the end of March 2025, it had been asked to carry out 781,576 traces.

Of those, 465,048 were successful, and 443,806 accounts had been found with value. The bank could not say how many of those people had their original paperwork.

Melanie Clarke

Melanie ClarkeMelanie Clarke did not initially know what was in front of her when she found premium bond papers among her late father Hugo’s affairs.

Her mother explained some were a gift for her and her sister, while some remained in her parents’ names.

She said: “They’re quite delicate and flimsy…[I thought of the papers] what part of that is important? How do I found out any information about this?”

Mr Clarke first came from Trinidad to the UK as an RAF Serviceman, aged 19, as part of the so-called Windrush generation.

He did not leave a will when he died from natural causes related to vascular dementia in 2018.

While clearing his possessions Ms Clarke misplaced the paperwork, and is now in a weeks-long exchange with NS&I trying to trace the accounts.

She believes many people of her generation would have been bought Premium Bonds when they were children, but will have little idea how to trace their accounts.

Sam Richardson, deputy editor at consumer group Which? Money, said NS&I was not signed up to the government’s own Tell Us Once service or its private equivalent, the Death Notification Service. The schemes help bereaved people by simplifying the process of notifying multiple organisations after a death.

The bank said its services “often required more individualised contact with executors” than the Tell Us Once scheme, but it wanted to be “as easy to use as possible… during difficult events”.

‘Computer says no’

BBC Morning Live’s resident money expert Iona Bain said NS&I needed to consider how it could improve.

“In theory, it shouldn’t be the end of the world if you don’t have the original certificate, perhaps because they’ve been mislaid or damaged,” she said.

“NS&I encourages people to come forward even if they only have basic details, as these can be matched up with what’s in the system.

“But the reality is more complicated. The majority of traces may be successful, but too many people have been left unhappy with what they feel is a ‘computer says no’ approach, even when they believe they have most of the details needed to find a match.

“Whilst it can be administratively complex to track down historic money, NS&I needs to consider how it can improve this process so it’s much less rigid, bureaucratic and frankly disappointing.”

Miss Lawrence has begun a petition calling for reform so names, dates of birth and address at time of purchase would be enough to locate an account.

Other difficulties she has highlighted include:

- a lack of awareness about premium bonds paperwork when it is found among a relative’s possessions after they have died

- people who had paper bonds bought for them when they were minors not being aware they had to take steps to have the bonds transferred to them when they reach 16

- people finding bond certificates that have a holder’s number, date and location of purchase, but the NS&I being unable to tell them to whom they belong

Reacting to the figures, Liberal Democrat Treasury spokesperson Daisy Cooper MP said it was “time for ministers to get a grip on this situation” by creating a new information campaign and new dedicated phone line about these “dormant millions”.

How can you find your account?

NS&I’s tracing service can be contacted online, by post or over the phone, if people do not have their bond number or NS&I number.

They can also use MyLostAccount which is associated with UK Finance and the Building Societies Association, and can be used to trace old accounts with other providers as well as NS&I.

People with original paper bonds such as those purchased over the counter at the Post Office can register them online or call the helpline on 08085 007 007.

A request can also be made for a trace by someone who is legally entitled to act on someone else’s behalf, for example under a Power of Attorney or by an executor of a will.

More about this story

The Shared Data Unit makes data journalism available to news organisations across the media industry, as part of a partnership between the BBC and the News Media Association.

Read more about the Local News Partnerships here.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.