Will traditional British TV survive US streaming giants?

56 minutes ago

Katie RazzallCulture and Media Editor•@katierazz

Katie RazzallCulture and Media Editor•@katierazz

BBC

BBCJust before Christmas, in a private dining room in the upmarket Charlotte Street Hotel in the heart of London’s Soho, the BBC’s director general gathered some of the UK’s leading TV creatives and executives for lunch. As they ate, surrounded by kaleidoscopic-patterned wallpaper and giant artworks, they were also chewing over the future survival of their own industry.

As solutions were thrown around to what many see as an acute funding crisis in the age of global streaming, one of the invitees suggested, in passing, that BBC Studios (the corporation’s commercial content-producing arm) could merge with Channel 4 to create a bigger, more powerful force to compete with the likes of Disney Plus, Netflix and Amazon.

As another diner knocked down the idea, I’m told that Tim Davie, the BBC’s DG, asked why it was so ridiculous.

I relate that not because it has come to fruition. It hasn’t. Nor even to suggest that the Director General supports the idea.

Instead the story illustrates the belief, among some within the broadcasting industry, that nothing should be off the table when it comes to contemplating how to ensure the survival of British-originated and British-focused TV as we know it.

Getty Images

Getty ImagesMany of the people I spoke to for this piece didn’t want to be quoted. But Sir Peter Bazalgette, the former Chairman of ITV, told me that what he termed the current “generous spread” of British broadcasters (BBC, ITV, Channel 4 and Channel 5) will need some consolidation or, at the very least, more cooperation in future.

“We’re in danger of having no public service broadcasting within a decade, certainly within 20 years,” he says. “We don’t have a strategy for their survival. It’s that serious. The regulators need to start thinking about it.

“Mergers may well be part of the answer. There should be fewer companies in the future.”

Lord Vaizey, who was Culture Minister under David Cameron, put it baldly. “ITV, Channel 4 and Channel 5 should merge.

“The UK only has room for two domestic broadcasters.”

AFP via Getty Images

AFP via Getty ImagesOthers, however, argue that distinctiveness is good for viewers. Channel 5 President Sarah Rose told me she “couldn’t disagree with Ed Vaizey more” – calling it a “Doomsday prophecy”.

Channel 5 is profitable, she tells me; it invests in smaller production companies and offers plurality for British audiences. By having just one commercial channel, “You’re taking the funnel from three to one types of content for British audiences.”

Channel 4 also rejects the suggestion of any merger. Its outgoing CEO Alex Mahon argues that, “The unique structure of competition between our publicly funded and commercially funded broadcasters” is what makes UK public service TV “so excellent”.

And yet the days of turning on your TV and finding an electronic programme guide listing channels – with BBC1 and BBC2 at the top, then ITV, Channel 4 and Channel 5 – are disappearing. The proposed date for the dawn of a new era is 2035; the end of traditional terrestrial TV as we know it.

When the increasingly expensive contracts to provide broadcast channels and digital terrestrial services like Freeview come to an end, the UK’s broadcasters are likely to pivot to offering digital-only video on demand. (However this won’t happen without a campaign to ensure older people are protected, as well as rural and low-income households who may not have high quality internet access.)

But if the aerials are turned off in 2035, is this the moment TV as we know it changes forever? If it becomes a battle between online-only British streamers and their better-funded US rivals, can the Brits survive? And, crucially, what will audiences be watching?

How TV could look by 2035

Flash forward to switching on the television in 2035 and there will of course have been certain technological transformations – perhaps more immersive viewing experiences or some shows viewed through augmented reality glasses. What’s highly likely, though, is that the communal big screen will still be a staple, (albeit probably voice-activated by then).

It’s a shift that has already begun with YouTube viewers changing their viewing habits and moving to the bigger screen. In 2024, for the first time, TV sets were the most-used device for watching content on the video sharing site at home, according to recent data from the Broadcasters Audience Research Board (Barb). In all, 41% of YouTube viewing was done on TV sets, ahead of 31% on smartphones.

With YouTube an apparently unstoppable force, in ten years’ time it could well become the go-to viewing for the majority.

“We are likely to continue to see a shift in the share of viewing time and advertising revenue towards globally-scaled players and user-generated content platforms like YouTube and TikTok,” all within the next five years, according to Kate Scott-Dawkins, Global President for Business Intelligence at media investment company Group M.

There’ll also likely be Netflix, Disney, Apple, Amazon. In other words, the global players, based in the US, many of which also have other revenue streams (whether parks, computer hardware or a vast shopping platform).

Getty Images

Getty ImagesKate Scott-Dawkins, Global President for Business Intelligence at media investment company Group M tells me the UK broadcasters are facing what could be an “existential” battle against US-based media companies with “wildly different business models”.

The shift to streaming TV has, she says, “enabled large globally-scaled players to get even bigger and pour money into content that they can put in front of worldwide audiences”.

The “big players with big pockets” already pay for a bespoke button on certain remote controls, or their own content tile front and centre on the homepage on smart TVs.

Ms Scott-Dawkins believes that in the future it will be “a position of strength” to own the operating systems themselves, as well as the media that people are watching on them. For example, this might mean Apple showing its films and television series on Apple TVs and iPhones, or Amazon showing its own productions via its Fire devices, or Google through its own computers and phones.

Questions of revenue

Part of the problem is that the UK terrestrial channels can’t compete financially with the streamers. Netflix, for example, is valued at $472bn (£356bn).

The BBC has lost 30% of its income – or £1bn a year – in real terms since 2010, as the licence fee has become worth less. ITV’s share price hasn’t yet recovered since the advertising downturn in 2022, despite its vast production arm, ITV Studios, boosting its earnings before tax to £299m.

Meanwhile, Channel 4’s recorded a deficit of £52m for 2023. Alex Mahon told Parliament last month, “We will pretty much break even in the year”.

Getty Images

Getty ImagesSome TV insiders think the solution will be one gateway or app for all public service content: one place to find all shows from BBC, ITV, Channel 4 and 5.

Alex Mahon recently told a newspaper that there needs to be “more collaboration” between the UK broadcasters – a way of “making sure we’re not duplicating the same technology”.

ITV has spent hundreds of millions to create ITVX, its streaming platform for the Netflix-age. Channel 4 took a pioneering approach to its own digital transformation, launching 4oD back in 2006; the first broadcaster in the world to offer television content on-demand.

But while its current £1bn a year revenue enables it to compete as a significant content creator, this may not be enough to sustain a modern distribution platform with all the associated investment costs into the long term, according to some insiders.

Lord Hall, the former BBC Director General, is among those arguing that it’s not sustainable for individual broadcasters to continue going it alone. “The notion that everyone has their own portals when you are competing against the huge streamers is not going to survive into the future,” he says.

‘One big streamer under iPlayer’?

Could the solution be for BBC iPlayer, which has been built with public money, to become the portal for the other British public service media content, too? It would be a single place where viewers could find ITV’s The Chase, Channel 4’s The Great British Bake Off and Channel 5 News, alongside BBC’s The Traitors. This was one idea suggested to me by multiple TV insiders. “One big streamer under iPlayer”, as one TV executive described it to me, “a modern public service streaming service”.

Part of their argument is that it’s the fastest growing streaming service in the UK – and the only existing platform of plausible scale to compete.

With political support and the right deal, ITV, Channel 4 and Channel 5 could potentially get behind sharing tech (after all, the streaming service Freely, which launched last year, already hosts their content with the BBC’s and others).

But the idea of branding this all under the BBC iPlayer is – unsurprisingly – not something that commercial broadcasters would likely entertain, according to conversations I’ve had.

Comic Relief via Getty Images

Comic Relief via Getty ImagesLord Hall believes, “It could be branded differently… It would be a very good step.”

He says: “The public would have to get used to the fact that BBC material would be free of advertising, and other parts of the platform would have adverts.”

If the idea of a shared streaming service sounds familiar, that’s because it was proposed years ago. Project Kangaroo was a plan by BBC Worldwide, ITV and Channel 4 for a UK video-on-demand joint venture. Think an early rival to Netflix.

But the UK’s Competition Commission blocked the project in 2009 because of concerns it could harm competition in the emerging VoD market.

Other regulators across Europe have also blocked mergers: In France, the TFI and M6 channels were prevented from merging. Two of the largest TV and radio broadcasters in the Netherlands, which would have combined eight national TV channels and four national radio stations, were also stopped for competition reasons.

Any form of merger between different public service broadcasters would be subject to the same scrutiny. It’s perhaps why Sir Peter Bazalgette is calling on UK politicians and regulators to focus on creating a strategy – or risk the end of British TV as we know it.

Nostalgia versus a changing world

Today, people in the UK spend more time watching traditional broadcasters than they do streaming services. Figures show 87% of people age four and above watch the traditional broadcasters each month and they spend an average of 137 minutes a day doing so. By comparison, 78% of people watch a streaming service and they spend only 40 minutes a day doing so.

If this does shift and the pattern reverses, TV producers and executives may be worried. But does it really matter to audiences?

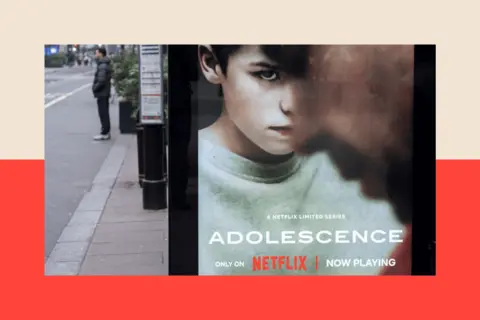

Netflix is already making the types of shows that may have previously been made by the likes of the BBC (Adolescence, Toxic Town and Baby Reindeer are all very British stories made by the streamer). So what is the problem? (Aside from the obvious point that you need a subscription to watch Netflix.)

Getty Images

Getty ImagesMs Rose argues that the picture is “much more complex”. Creatives involved in those shows often cut their teeth in public service TV, she says – one of benefits of the traditional broadcasters is, she believes, that it is a pipeline of talent.

Sir Peter Bazalgette argues that they’re needed more than ever in our AI age to serve as “a gold standard of trusted news for our democracy, amid the online Tower of Babel.”

He also argues for programmes that reflect “our shared values and national conversation”. Would a US-based streamer have chosen to make Mr Bates v the Post Office (ITV), for example, or ‘It’s A Sin’ (Channel 4) – stories that are uniquely British and reflect who we are?

Backing producers to take risks is, says Lord Hall, “exactly what the BBC should be doing – but of course [it] has been doing less because the licence fee has been consistently cut”.

Start of the ‘martini streaming age’

Ultimately, the American streamers are here to stay; they’re spending billions and their UK operations are often led by British executives who are supportive of Britain’s public service broadcasting scene.

I have also picked up a sense from those inside Netflix that the company is often used as a battering ram to persuade the government that the UK’s traditional broadcasters need more protections.

Some have also been critical of the BBC for, as they see it, wanting everything on its own terms: “‘We want you to give us your money for co-productions, but the BBC will make all the creative decisions’,” is how one insider put it to me, unfairly or not.

In 2018, Netflix CEO Ted Sarandos was invited to the BBC’s New Broadcasting House in London. Invitees recall that he talked warmly about how influential the BBC’s iPlayer had been to the success of Netflix, describing how impressed he had been by a piece of kit that had got British viewers used to getting their video on demand.

With more than 17 million Brits now subscribed to Netflix, there is a certain irony to that.

Today, as the BBC’s Director General Tim Davie starts to position the BBC ahead of the renewal of the corporation’s charter after 2027, the TV landscape is changing fast. And the challenges are clear.

Lord Hall tells me: “Our lives will be enriched by having not only what the streamers can offer, but also what the public service broadcasters can bring. It’s unthinkable not to build on what the BBC and others can deliver”.

Sir Peter Bazalgette predicts that, “Small doesn’t cut it,” adding that, “The winners will have to be big enough to [both] afford high end dramas for winning subscribers and maintain large back catalogues to keep subscribers happy.”

He says we now live in “the ‘martini’ streaming age – any time, any place, anywhere”.

The question is whether the leaders of the public service broadcasters can forge the right plan to safeguard their industry in that age.

More from InDepth

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can send us your feedback on the InDepth section by clicking on the button below.