CoinDesk 20 Performance Update: XRP Falls 9.9%, Leading Index Lower from Monday

Litecoin also joined Ripple as an underperformer, falling 6.1%.

Dec 3, 2024, 2:20 p.m. UTC

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

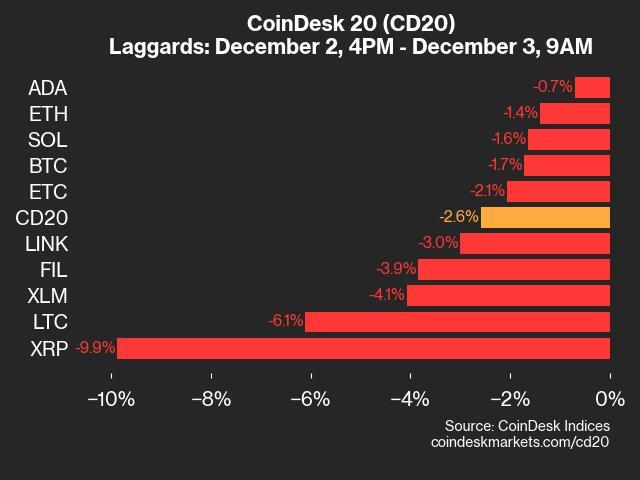

The CoinDesk 20 is currently trading at 3764.72, down 2.6% (-100.09) since 4 pm ET on Monday.

Nine of 13 assets are trading higher.

Leaders: HBAR (+11.0%) and POL (+9.8%).

Laggards: XRP (-9.9%) and LTC (-6.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Tracy Stephens

Tracy Stephens is Senior Index Manager at CoinDesk Indices, where she works to maintain the high standards of robustness and rigor of systematic trading found in traditional finance in index and data products. Before transitioning into crypto, she built systematic macro-trading strategies as a quantitative researcher at Alliance Bernstein, one of the largest asset managers in the U.S., and at Citibank. Tracy holds a Bachelor’s degree in Math from Barnard College and a Master’s degree in Data Science from the University of California, Berkeley.