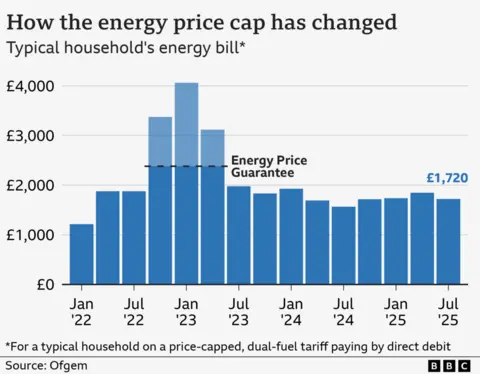

Household energy bills fall but may not go much lower

3 hours agoKevin PeacheyCost of living correspondent

Getty Images

Getty ImagesEnergy prices will fall from Tuesday for 21 million households in England, Scotland and Wales but uncertainty remains over whether costs will stay down for winter.

The bill for a household using a typical amount of gas and electricity is dropping by £11 a month, under regulator Ofgem’s latest price cap.

While billpayers have welcomed the 7% cut, there is concern that bills will still hit hard later in the year when it is colder and darker.

People are being encouraged to shop around to see whether a fixed deal which could provide more certainty over payments would be more suitable.

The future direction of prices is hard to predict. While little change had been expected for prices this autumn, uncertainty in the Middle East could still have an impact on wholesale prices, with a knock-on impact on household bills.

Analysts at the energy consultancy Cornwall Insight have forecast a further 1% drop in October.

This would take the annual bill for a household using a typical amount of gas and electricity to £1,697 a year – but Cornwall Insight said there was “significant uncertainty” over the forecast.

“The cap still remains hundreds of pounds above pre-pandemic prices, even when adjusting for inflation. Furthermore, there is little indication that prices will reduce substantially over the next few years,” it said.

Ofgem is urging people to consider fixed deals, which the regulator said could lead to a £200 annual saving.

Those already on fixed deals will not see any change to their monthly payments following Tuesday’s price cap change.

Currently 35% of billpayers are on a fixed tariff, up from just 15% a year ago when fewer offers were available.

However, a fixed deal only sets the unit rate. Actual household bills depend on how much energy is used.

At this time of year heating is usually off, so families typically focus on the cost of cooking, particularly as food prices have been rising sharply.

Budgeting

Nadina Hill, a mother-of-two who works part-time at an emergency services control room, has been trying to keep on top of her cooking and energy costs.

“It is a struggle, because the price of everything always goes up,” the 45-year-old said. “I have to budget carefully.”

She took part in an eight-week course with her daughter Gracie, 14, that taught them about cooking healthy food more cheaply.

“We made some meals we’d never made before and used different types of ingredients,” she said.

The Community Kitchen, run by Stevenage Football Club Foundation, has helped hundreds of families, and focuses on menus with portions costing £1 or less.

Hannah Marsh, head of health and wellbeing at the foundation – the charitable arm of the club, who created the programme, said key tips included:

- Using recipes like pizza in a pan, to avoid having to use the oven

- Bulk cooking meals, some of which can be frozen for later

- Planning and budgeting for what you will cook throughout the week

- Considering using tinned or frozen vegetables which could be cheaper

Gracie said that even her pet rabbit Clover, and guinea pigs, Miles and Patch, benefitted from the course.

“Instead of wasting all the peelings and putting them in the bin, we would give those as a treat,” she said.

How the price cap works

Every three months, the regulator’s price cap sets a maximum that suppliers can charge for each unit of energy, which applies to anyone on a variable tariff in England, Scotland and Wales. The price cap does not apply in Northern Ireland, which has its own energy market.

Customers on variable deals can estimate how much their energy bill will fall by knocking 7% off their previous monthly direct debit.

Ofgem illustrates the change in prices by showing the impact on the annual bill for a household using a typical amount of energy and paying by direct debit. This has dropped by £129, to £1,720.

Prices are still considerably higher than before the Covid pandemic. That means people have had to adapt their lifestyles and finances.

Jenny David, who lives in Bridgend with her husband, Mark and two children, Anwen and Hywel, said the family had worked out new ways to save.

“It’s become [our] new norm,” she said “You don’t even notice you’re doing things.”

She is a nurse and her husband works in his family’s kitchen and bathroom fitting business.

They invested in an air fryer and meticulously plan their shops. Jenny said she was used to being active, but to save money on the cost of gym membership and classes she now attended a free weekly outdoor fitness class.

New energy prices

Another strategy for managing energy expenditure is for households to provide regular meter readings to suppliers, to ensure companies charge for energy use at the correct rate.

The latest changes mean variable tariffs for a customer who pays by direct debit are as follows:

- Gas prices are capped at an average of 6.33p per kilowatt hour (kWh) down from 6.99p

- Electricity is capped at 25.73p per kWh down from 27.03p

- Standing charges vary by region but have fallen on average to 51.37p a day for electricity, from 53.8p

- Standing charges for gas have fallen to 29.82p a day for gas, from 32.67p

In addition:

- A typical household uses 2,700 kWh of electricity a year, and 11,500 kWh of gas

- Households on pre-payment meters pay slightly less than those on direct debit, with a typical annual bill of £1,672

- Those who pay their bills by cash or cheque pay more, with a typical annual bill of £1,855.

The regulator is considering changes to the system of standing charges, although that has brought renewed debate over how they operate.

Winter fuel payment U-turn

The government’s decision last year to limit eligibility for the winter fuel payment, focused concern on the cost of energy for pensioners.

However, opposition from charities, backbench Labour MPs and unions, led to a U-turn from the prime minister and chancellor.

The reversal means 75% of pensioners in England and Wales will receive the payment in winter 2025, and the rules will be similar in Scotland.

From this winter, the payment of £200 or £300 per pensioner household, will go to those with an annual income of £35,000 or less.

The Warm Home Discount, which is worth £150, will also be extended this winter.

Anyone on means-tested benefits will automatically see the money knocked off their bills no matter what size of property they live in.

Additional reporting by Abi Smitton