Everything you need to know about the Budget

5 hours ago

Getty Images

Getty ImagesChancellor Rachel Reeves is expected to increase taxes in the Budget later.

Ahead of delivering her Budget statement, Reeves said she will take “fair and necessary choices” for the economy, to bring down NHS waiting lists, the national debt and the cost of living.

The chancellor said she will push ahead with “the biggest drive for growth in a generation”, which will include sweeping investments across many sectors, to build a “fairer, stronger and more secure Britain”.

The statement will be made in the House of Commons at about 12:30 GMT. The leader of the opposition, Conservative MP Kemi Badenoch, will give an immediate response.

What has already been announced?

The minimum wage for over-21s will go up by 50p an hour to £12.71 in April 2026, Reeves announced on Tuesday, ahead of the Budget.

For workers aged 18 to 20, the minimum wage will rise to £10.85, an increase of 85p. The government wants to eventually scrap the separate rate for this age group, creating a single minimum wage for all adults.

For 16 and 17-year-olds and apprentices, the minimum wage will increase to £8 an hour, up from £7.55.

After the minimum wage went up last year, businesses warned that another increase could result in hiring freezes or job cuts.

Over 21s to get £12.71 an hour as minimum wage increased

A so-called milkshake tax has been announced ahead of the Budget.

The existing sugar tax, which mainly applies to fizzy drinks, will be applied to bottles and cartons of milk-based drinks, including milkshakes, flavoured milk, milk substitute drinks and lattes.

That could add a few pence to these drinks. Or, as has happened with some fizzy drinks, manufacturers may lower their sugar content to avoid the tax.

Sugar tax extended to milk-based drinks

What other tax rises could be in the Budget?

The government is looking at a range of options to help it raise more money.

Reeves has confirmed that both tax rises and spending cuts are on the table.

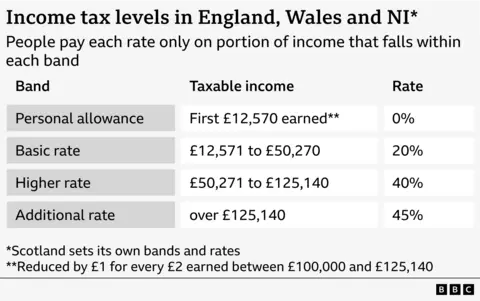

According to government sources, Reeves has decided not to raise income tax rates, a move that had been widely expected.

However, speculation remains that the chancellor could extend a freeze on income tax and NI thresholds beyond the planned 2028-29 deadline.

Freezing thresholds means that, as salaries rise over time, more people reach an income level at which they start paying tax and NI. Some people have to start paying higher tax rates.

Reeves backs away from income tax rates rise

The chancellor is planning to raise about £2bn by limiting a tax break on pension contributions, the Times has reported.

It suggested Reeves could put a £2,000 cap on the amount workers can put into their pensions under “salary sacrifice” schemes without paying National Insurance. At the moment there is no limit.

It would mean that any contributions above the cap would be subject to NI payments by both employees and employers.

For people receiving the full rate of the new state pension, the chancellor is expected to confirm an increase of more than £550 a year from April.

This is due to the “triple lock”, which means the state pension increases by either 2.5%, inflation, or average earnings growth – whichever is the highest figure.

What is the triple lock and how much is the state pension?

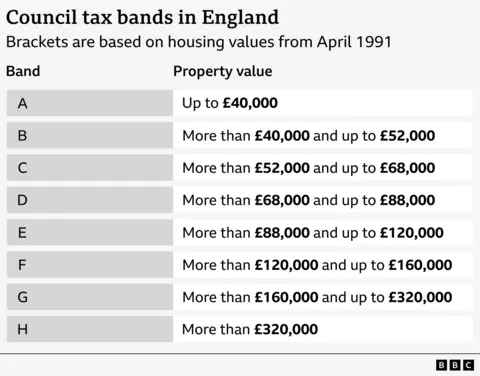

Reeves is planning to introduce a new tax on high-value homes in England, both the Times and the Telegraph have reported. About 2.4 million properties in council tax bands F, G and H will be revalued, they said.

The tax will apply to properties worth more than £2m, which will affect about 100,000 homes with an average surcharge of £4,500, the Times said.

There have also been suggestions that more landlords should pay NI. At present, if being a landlord is not your main source of income, you may not pay any.

The Resolution Foundation think tank suggested that all landlords should pay NI at a basic rate of 20% with an additional rate of 8% for property earnings above £50,270 a year.

The chancellor is considering a new tax on electric vehicles (EVs). This could help make up for the fall in fuel duty as more drivers move away from petrol and diesel cars.

According to the Telegraph, EV drivers could be charged 3p per mile, on top of other road taxes, amounting to an extra £12 on a journey from London to Edinburgh.

A government spokesperson told the BBC: “Fuel duty covers petrol and diesel, but there’s no equivalent for electric vehicles. We want a fairer system for all drivers.”

The Budget is also expected to include an extra £1.3bn in funding for the Electric Car Grant scheme, which offers subsidies of up to £3,750 for eligible models.

What taxes apply to electric vehicles?

The government may limit the tax break that people can get when buying a bicycle through the Cycle to Work scheme, according to reports.

A limit on how much people can spend on a bike through the salary sacrifice scheme could be introduced, the FT said.

The scheme offers savings of 42% of the cost of a bike for higher rate taxpayers and 30% for basic rate taxpayers. A previous spending cap of £1,000 was lifted in 2019.

Sturti/Getty Images

Sturti/Getty Images

The chancellor is reportedly planning to cut the amount of money that can be saved tax-free in cash Individual Savings Accounts (Isas).

Reports have suggested that Reeves could reduce the annual allowance from £20,000 to £12,000.

However, cutting the cash Isa limit is unlikely to have the intended effect of promoting investment in stocks and shares, MPs on the Treasury Select Committee have said.

What is an Isa and how might the rules change?

The government is expected to close a tax loophole which UK firms argue gives an unfair advantage to foreign online retailers such as Shein.

At the moment, overseas retailers can send packages worth less than £135 to the UK without paying import duties, but this would end.

The TUC, the umbrella group for UK trade unions, has called for higher taxes on banks and online gaming companies.

In September, the chancellor told ITV News that “there is a case for gambling firms paying more”.

What can nervous businesses expect from the Budget?

What other measures could be in the Budget?

Parents can only claim universal credit or tax credits for their first two children. The rule applies to third or subsequent children born after 6 April 2017.

The chancellor hinted at changes when she told the BBC it was not right that children in bigger families were “penalised”.

She could scrap the limit entirely or extend the benefit to all families, irrespective of the number of children, but at a lower level.

What is the two-child benefit cap and how could it change?

Mike Harrington/Getty Images

Mike Harrington/Getty Images

The BBC understands the government could bring down gas and electricity bills by cutting the current 5% rate of VAT charged on energy, or reducing some regulatory costs which suppliers can pass on to customers.

Reeves has said that young people who have been out of work for 18 months will be given paid placements to help them find employment.

How many Neets are there in the UK?

Why is the chancellor expected to put up taxes?

The chancellor needs more money in order to meet self-imposed rules for government finances which she says are “non-negotiable”. The two main rules are:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament

The Office for Budget Responsibility (OBR) – the government’s official forecaster – has assessed the gap in public finances to be close to £20bn, the BBC understands.

How is the UK economy doing?

The government has repeatedly said that boosting the economy is a key priority.

A growing economy usually means people spend more, extra jobs are created, more tax is paid and workers get better pay rises.

In October, the International Monetary Fund (IMF) forecast that the UK was set to be the second-fastest-growing major economy in 2025. However, it also predicted that the UK will face the highest rate of inflation among G7 nations in 2025 and 2026.

The latest official figures show the UK economy grew by 0.1% between July and September – less than the expected 0.2%.

Meanwhile, government borrowing – the difference between public spending and tax income – reached £17.4bn in October, which was higher than expected.

Borrowing for the financial year to date has now reached £116.8bn, which is nearly £10bn more than the OBR had forecast in March.

Prices are still rising faster than expected, with inflation at 3.8% in the year to September – well above the Bank of England’s 2% target.

Here’s what you want to see in the Budget