Calculator: How will freeze on tax thresholds hit your take-home pay?

2 hours agoTommy Lumby,Business data journalistandPhil Leake,Data journalist

BBC

BBCWages have been rising faster than prices for the last two-and-a-half years – the longest stretch since the 2008 financial crisis.

But you could be paying more tax on a rising salary because of frozen thresholds, which will remain in place until 2031 after the UK government extended the policy in its Autumn Budget.

Use our calculator below to see how your pay could be affected.

The calculator applies to employees in England, Wales and Northern Ireland. Tax bands in Scotland are different, and self-employed workers are taxed differently.

Tax thresholds are the points at which you start paying more income tax and National Insurance on each extra pound you earn, as your salary rises.

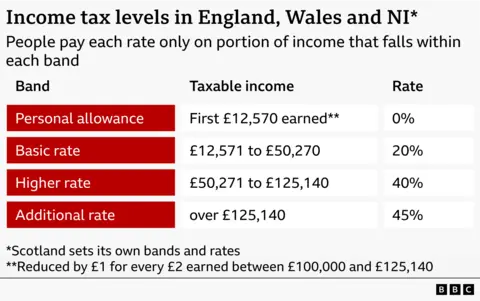

You pay no income tax on the first £12,570, which is known as the personal allowance.

You then pay 20% on earnings between £12,571 and £50,270 – the basic rate – and 40% on anything between £50,271 and £125,140, which is the higher rate. Anything above £125,140 is taxed at 45%.

If you earn more than £100,000 after accounting for certain tax reliefs, you start to lose £1 from your personal allowance for every £2 you earn over that point.

Governments have historically raised tax thresholds in line with inflation, to try to ensure your take-home pay keeps up with the cost of living.

Weekly earnings across Britain grew at an annual rate of 0.8% between October and December after accounting for inflation, the latest Office for National Statistics (ONS) data shows.

That means growth in average salaries has now consistently beaten the pace of price rises since July 2023.

But thresholds have been frozen for the whole of that period and will remain stuck into the next decade.

According to our calculations, the freeze in thresholds will add £465 to the 2030-31 income tax and National Insurance bill for someone currently earning £39,000, which is the salary of the average UK worker.

Of that, £227 would be due to the extended freeze announced by the current Chancellor Rachel Reeves in November.

Someone on £50,000 would pay an estimated £1,309 more, of which £704 would be because of the extension from 2028-29.

You can read more about how the calculator works in the final section of this article.

Freezing thresholds is often called a stealth tax by economists because it increases the tax take without a government having to put up rates.

Both Labour and Conservative governments have used it to raise additional revenue. Extra money from tax receipts helps pay for public services such as the NHS, schools and welfare spending.

Most earners will pay more because of the freeze. But people whose pay rises move them across the thresholds into the basic and higher rates are likely to see the biggest jumps in what they owe.

The government published its own analysis of a range of its tax and spending decisions since late-2024, including frozen tax thresholds. This found the lowest income households benefit, and the highest lose out.

But this only goes up to 2028-29, so does not include the period covered by the extended freeze.

Analysis by the National Institute of Economic and Social Research (Niesr) shows lower and middle-income households are worst hit by the extension to the freeze, in percentage terms.

Thresholds were initially frozen in 2022 by former Conservative Chancellor Rishi Sunak, who paused them until 2026.

The Conservatives later extended that for a further two years, before Reeves announced she would keep it in place until 2031.

By 2030-31, official forecaster the Office for Budget Responsibility (OBR) estimates an additional 5.2 million people will be paying the basic rate of income tax because of threshold freezes first introduced in 2022-23.

An estimated 4.8 million more will be paying the higher rate, and 600,000 more the additional rate.

It forecasts that the freezes to income tax thresholds will generate £56bn in revenue in 2030-31. Of that, £12bn will be down to Reeves’s extension.

Additional reporting by Lucy Dady and Jess Carr

How the calculator works

This calculator estimates how much extra tax and National Insurance contributions (NICs) you will pay in 2030-31 due to frozen tax thresholds.

Using official forecasts produced by the OBR for the November 2025 Budget, it estimates the extra amount you could pay compared with if thresholds had been allowed to rise from 2026-27, and how much of that is down to the current government’s extension of the freeze from 2028-29.

The calculator does not store your results.

What does the calculator not take into account?

This calculator is designed to give you an idea of how much frozen tax thresholds could affect how much tax you pay over time, but there are various other factors that can determine your tax bill.

For example, if you are over the state pension age, you could be exempt from paying NICs. You can also get tax relief on pension contributions.

There are various other taxes you could pay, and tax credits and allowances you could potentially claim, which this calculator does not take into account.

It applies to employees working in England, Wales and Northern Ireland only. Scotland has different tax bands and thresholds.

It does not apply to self-employed workers, who are taxed differently.

How does it calculate how my earnings will rise?

It assumes your salary will rise in line with the OBR’s financial year forecasts for average weekly earnings growth each year. These forecasts are the OBR’s best estimate of how wages across the labour market will rise in the future, and actual wage growth could be different.

It also assumes your salary remains regular. If it fluctuates or you change jobs, this could affect how your earnings rise.

How does it calculate how tax thresholds will rise?

The calculator uses the same Consumer Prices Index (CPI) inflation figures the OBR uses to estimate how tax thresholds would rise in the future. Actual inflation could be higher or lower.

The personal allowance (PA) is rounded up to the nearest £10, and the basic rate limit is rounded up to the nearest £100. The additional rate threshold rises in line with the PA, which means your PA goes down by £1 for every £2 you earn over £100,000.