Food prices continue to surge as inflation remains at 3.8%

1 hour agoDearbail JordanBusiness reporter

Getty Images

Getty ImagesFood price inflation rose for the fifth month in a row in August with costs rising at the fastest pace since the beginning of last year, official figures show.

The cost of food and non-alcoholic drinks grew at an annual rate of 5.1% as beef, butter, milk and chocolate prices continued to surge.

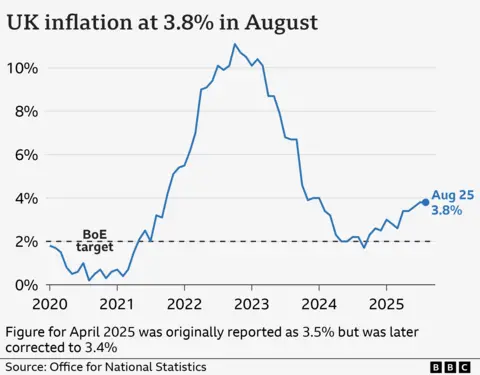

However, despite the increase in food costs, price growth in other areas such as air fares slowed, leaving the overall rate of UK inflation at 3.8% – the same as July.

Economists said food bills have been rising because supermarkets were passing on government increases in the minimum wage and National Insurance Contributions (NIC) to shoppers through higher prices.

Overall inflation remains above the Bank of England’s 2% target and expectations are growing that its rate-setting committee will hold interest rates on Thursday.

Chancellor Rachel Reeves, who will set out the government’s tax and spending plans in the Budget on 26 November, said that she knew “families are finding it tough and that for many the economy feels stuck”.

She added: “That’s why I’m determined to bring costs down and support people who are facing higher bills.”

In her first Budget last year, Reeves announced an increase in National Insurance Contributions for employers as well as a rise in the minimum wage.

The decision led to a backlash from many businesses, who argued it would lead to higher prices for customers.

Reeves previously told firms after she would not be “coming back with more borrowing or more taxes”, but speculation is growing over what taxes the chancellor will hike.

Shadow chancellor Sir Mel Stride said price growth was “deeply worrying for families” and said Labour’s tax policies are “stoking inflation”.

The Office for National Statistics (ONS), which publishes the figures, said the 5.1% increase in food and drink prices is the highest rate for 19 months.

It also said that inflation in the UK was “significantly higher” than the estimates for large European economies such as France and Germany.

In August, France’s inflation was 0.8% while Germany recorded price growth of 2.1%.

Yael Selfin, chief economist at KPMG UK, said Britain had become “an outlier in recent months on inflation compared to other major economies”.

She said: “Since April, the rise in inflation has been driven largely by domestic policy choices, including the increase in employers’ National Insurance Contributions.

“These higher costs have been passed on by businesses to consumers, feeding through into higher headline inflation.”

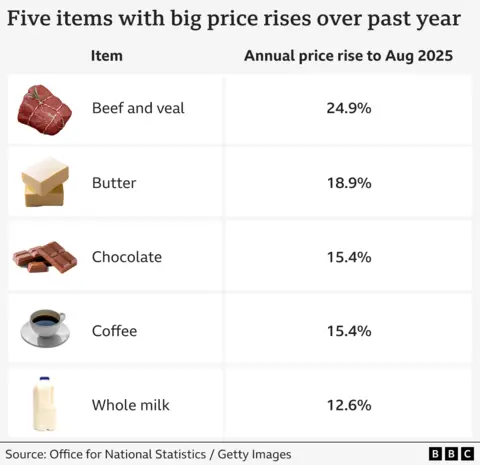

Some food items have continued to see particularly big increases. In the year to August, beef and veal prices were up nearly 25%, while butter prices grew by nearly 19% and chocolate rose by 15.4%.

The British Retail Consortium (BRC) said that food costs were outstripping average wage growth, which the ONS said reached 4.7% between May and July.

“With food inflation now outpacing wages, many families will be struggling with the rising cost of living,” Kris Hamer, director of insight at the BRC, said.

However, the prices of some goods such as clothing and footwear eased, which the BRC said was “driven in part by retailers discounting the last of their summer collections”.

It added: “Key staples such as cereals and pasta fell in price on the month.”

James Smith, developed market economist at investment bank ING, said the inflation figure was “certainly not good news for the Bank of England”.

He told the BBC that it remaining at 3.8% “means the prospect for further interest rate cuts this year very much hang in the balance”.

“In terms of where we go from here, food inflation could climb a little bit higher into the end of the year,” he added.

The Bank of England has cut interest rates five times since August last year, taking borrowing costs to 4%.

It has said it

The central bank is widely expected to hold interest rates on Thursday. It then has two further rate-setting meetings this year – in November and December.

Even with a projected rise in inflation, Capital Economics said it doubts the Bank will cut rates in November.

But Paul Dales, its chief UK economist, said: “We still expect the looser labour market to weaken wage growth and eventually bring down UK inflation to similar rates as in the US and the eurozone, which will allow the Bank of England to cut rates from 4% now to 3% by the end of next year.”

‘NICs rise has stung’

Butter and chocolate prices have directly affected Tom Egan, who co-founded and runs Coosh Bakery in Mapperley, Nottingham with his wife Rachel.

He said adverse weather conditions in cocoa-growing countries such as Ghana had “more than doubled the price we get from our suppliers”.

“I think previously we were paying somewhere in the region of £60 for 10kg,” he said. “I think it has now gone up to over £150 for that same 10kg.”

Butter prices have risen by 50% over the year, with suppliers telling Mr Egan that “the actual quantity of milk that is being imported into the UK has gone down so obviously supply and demand has meant the price has surged on things like butter”.

Meanwhile, he said the rise in National Insurance Contributions had “stung a little bit”, leading to the bakery being more cautious about investment in areas such as equipment and technology, which could improve productivity.

Additional reporting by Haider Saleem