I can’t sell Mum’s retirement flat – and it’s costing me thousands

4 hours agoAngus CrawfordBBC Investigations

BBC

BBCFamilies have told the BBC they are being left to pay thousands of pounds a year in fees for empty retirement properties inherited from loved ones.

They say retirement homes, which only people over a certain age are allowed to buy, can be hard to sell, even at hugely discounted prices.

One person told the BBC they had dropped the asking price of their late mother’s flat by £200,000 and still had no offers. As such properties fail to sell, families are left to pay ongoing service charges.

Another man told the BBC the annual cost of his late mother’s flat was more than £11,000 a year once ground rent, council tax and services charges were combined.

‘It’s become a millstone’

One expert estimated there could be 10,000 long-term, empty properties in privately owned retirement blocks across England and Wales.

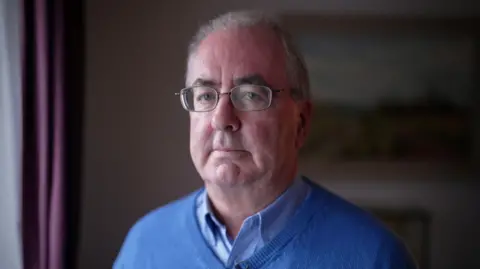

Gordon Taylor’s mother, Joan, moved into her flat in Burgess Hill in 2015, when she paid £225,000 for the 125-year lease.

It was in an “age restricted” block of flats for over-70s, built and run by one of the biggest developers in the country, McCarthy Stone.

It was part of their Retirement Living Plus portfolio, which includes on-site staff, an hour a week of home help and an in-house restaurant.

Taylor, 71, remembers that “as soon as the salesperson took her up to the flat, that was it, she was sold – she absolutely loved it”.

Joan died in June 2024, aged 96, and left her flat to her family.

However, it has been on the market and empty ever since and is now for sale for £170,000 – £55,000 less than it was bought for.

The terms of the lease mean it can only be bought by someone over the age of 70 and Taylor says there have been no serious offers.

In the meantime, the annual service charge of £9,700, ground rent of £435 and council tax of £1,044 mount up as unpaid debt.

“She probably thought she was leaving something to her offspring, only to find that it’s become a millstone,” says Taylor.

He says the market for the flats has collapsed, in part because future buyers are put off by the scale of the standing charges.

At least 18 other flats in the block of 56 are also empty and on the market, with the same lease restriction.

Taylor points out that four miles away, in Haywards Heath, McCarthy Stone is building a new development for the over 60s, despite Corbett Court being 30% empty.

“It’s a massive issue, it’s a national issue; the system in this sector is obviously broken,” he says.

McCarthy Stone told the BBC that, in a survey, 86% of residents at Corbett Court said they were satisfied with the development.

The company says it offers the option to defer the service charge and does all it can to help families “achieve a quick sale at a good price”.

It recognises that flats may decrease in value but insists its “in-house resales team has a strong track record of success”.

‘Can’t give them away’

The BBC has found that Taylor’s situation is repeated across England – including with other providers – with people unable to sell their dead relative’s property and struggling to pay standing charges.

We spoke to families in Berkshire, Hampshire, Buckinghamshire, Norfolk, West Sussex, Shropshire, London, Surrey, Leicestershire and Derbyshire.

One property we found had been vacant for more than nine years. In another case, family members face £60,000 in charges accrued since the property became vacant in 2019.

A relative told us it was “like a noose around our necks”, and another expressed frustration that “you can’t give them away”.

Another beneficiary reported paying service charges of £750 per month on a flat that has been empty for four years, describing it as a “never-ending nightmare”, adding: “It is infuriating and heartbreaking in equal measure.”

The Retirement Housing Group (RHG), which represents the industry, disputes the figures and claims that 95% of these kinds of properties are occupied.

It maintains the level of long-term empty properties in the sector is “not disproportionately high”.

Critics believe problems in the sector are caused by a combination of issues. They cite high service charges and a small, age-restricted pool of potential older buyers.

Restrictive leases, a fear of communal living post Covid, and an oversupply of similar accommodation are all possible factors.

Some housing experts believe the scale of the problem has been underestimated.

Adam Cliff is secretary of the Empty Homes Network, which supports housing officers in local authorities to bring properties back into use.

“A significant amount of homes are ready to be lived in, but are restricted in many cases by the contracts that are holding these people effectively to ransom,” Cliff says.

“People are even getting to the stage of saying, ‘How do we give these properties away?’ It’s heartbreaking to see and hear some of the stories of those not able to sell properties for two, three, four, sometimes five years or more.”

Read more

The RHG disputes this figure and say this kind of accommodation provides “independence, support and companionship in later life”.

The organisation says the sector is not immune to a downturn in the general housing market and insists there are measures in place to “support people during the resales process”.

But campaigners suggest several solutions to the problem, including the reduction or delay of service charges until a sale has gone through.

They say leases could be re-examined with age restrictions being potentially lifted and planning applications for new retirement developments should be considered in light of existing vacancies.

Taylor says his mother would be “pretty disgusted” and would be writing letters to the authorities.

He says: “I am going to keep fighting, I’m not going to stop.”