Rents rise £221 a month in three years, analysis suggests

55 minutes agoKevin PeacheyCost of living correspondent

Getty Images

Getty ImagesThe monthly cost of renting a home has risen by £221 in three years, according to property portal Zoopla.

The BBC has heard how the pressure has led to some tenants making decisions about jobs based on rent in the area, and parents who are helping their grown-up children with living costs.

The increase is very similar to the typical rise in monthly mortgage repayments for homeowners.

However, Zoopla says the rate of rent increases has slowed, particularly in cities.

The cost of renting has risen sharply in recent years due to high demand from tenants. At the same time, the number of properties available to rent has either fallen or failed to keep pace with demand.

Analysis by Zoopla, shared with the BBC, suggests that rents for new tenancies are 21%, or typically £221 a month, more expensive than three years ago.

The average monthly rent this spring was £1,283, the figures show.

Some renters are having to move or turn down jobs owing to high rents.

Neysa Killeen now works in musical theatre after studying in Dublin. She had wanted to accept a job in a school in the city but said the wage did not cover the rent.

“That was the first time I had to turn down a good opportunity,” she said.

After moving to the north of England, she has faced similar pressures.

“I’ve been able to do fringe shows but now I’m looking at having to move to somewhere else because realistically I won’t be able to keep up with the rent, and that’s the second time this will have happened to me and I’m 26,” she said.

One mum, called Karen, contacted us through Your Voice, Your BBC News to explain how her son – a father himself – needed financial help from her and her husband.

Her son is a graduate with a good job, but needed their help because rent was so high. However, she said her own plans to retire meant it was not a sustainable solution.

Lucian Cook, head of residential research at estate agency Savills, said more parents were acting as guarantors when tenancies were agreed. He said the period of high rental growth meant it was inevitable that parents were helping to pay the rent on an informal basis too.

Aneisha Beveridge, from Hamptons, said that many young people had been leaving the family home much later in life in recent years because of rent rises.

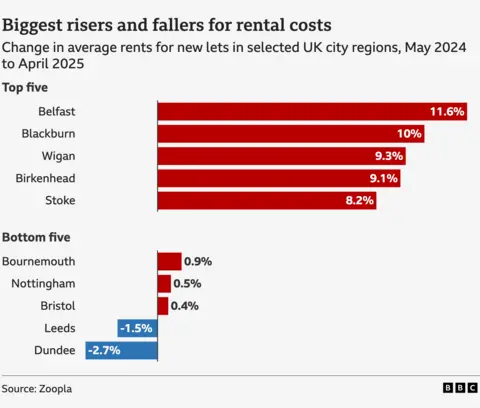

More encouraging news for renters is that Zoopla data shows that rent rises have slowed, or even reversed in some areas – particularly in cities.

Annual growth in average rents for new tenancies in the UK has slowed from 6.4% last year, to 2.8% in the year to April, according to Zoopla’s latest report.

Rents have fallen compared with a year earlier in Leeds, Dundee and parts of London.

However, they continue to rise quite sharply in more affordable areas adjacent to large cities.

Wigan, Carlisle, Motherwell, Chester and Blackburn have all seen annual rent rises of 8% or more.

Renters might not be able to buy

Over the last three years, homeowners were faced with much higher mortgage rates, and typically saw their monthly repayments on a new fixed deal rise by £218 compared with three years earlier.

Although the increase for renters and homeowners is very similar, Zoopla’s executive director of research Richard Donnell said that property owners tended to have bigger homes.

They were more likely to have a two to four-bedroom home, while renters were often younger and living in a one to three-bedroom home. Mortgage holders were also likely to be reducing their debt with each payment.

While rents and mortgage repayments were rising sharply, Zoopla said house prices were relatively steady.

They rose by 4% over the same three-year period.

Normally that would be a boost to first-time buyers, keen to see house prices stagnate rather than get even more out of reach.

However, rising rent and deposit demands mean the financial pressure can still be difficult to manage, even before a mortgage needs to be paid.

“I don’t know anyone who expects to be able to buy a house, it’s just not something we talk about,” said Neysa.

The government has announced a permanent extension to the mortgage guarantee scheme, which should ensure low-deposit mortgages remain available to first-time buyers.

The City regulator, the Financial Conduct Authority, has confirmed plans for simpler rules around mortgages.

There is also a plan to allow people to show evidence of rent payments as part of lenders’ affordability checks.

That would be welcomed by another stretched renter, Stefania Calhoun.

“I’m not look for an extravagant house, I’m not looking to live above my means, I just want a cosy house and to invest in something that’s mine and leave a legacy for the kids,” the 41-year-old said.

Lifelong renting

However, renters may not have any intention to buy, and Mr Donnell said they also needed support.

“Home ownership remains out of reach for a large proportion of households on lower to middle incomes with small deposits,” he said.

“This is a large and important group of private renters, who still face strong competition for rented property. Those on lower incomes tend to be limited in their ability to move home, which risks triggering higher rental costs.

“Policymakers need to prioritise measures to grow the supply of affordable rented homes to boost choice for lower income renters.”