Tips from first-time buyers: ‘We bought a £320,000 home aged 26’

29 minutes agoLucy AchesonBusiness reporter

Cameron Smith

Cameron SmithThe Bank of England has cut interest rates for the second time this year – welcome news for first-time buyers after years of rising mortgage costs and spiralling house prices.

But it’s still tough. More than half of first-time buyers still rely on the so-called bank of mum and dad to get on the property ladder, with an average of £55,572 given in loans and gifts last year, according to estate agents Savills.

We’ve spoken to people on a range of incomes who have managed to make it on to the ladder or are on the brink of buying.

They shared with us the tactics they used to buy.

‘We used a Lifetime ISA’

Cameron Smith and Georgia Pickford, both 27, each opened a Lifetime ISA (LISA) in order to buy a three-bedroom flat in Hertfordshire together for £320,000 last year.

The scheme allows 18 to 39-year-olds to save up to £4,000 a year, with a 25% government bonus, as long as it’s used to buy a home under £450,000.

Cameron earns £40,000 and Georgia £37,000 and they each set up a direct debit to their respective LISA accounts.

“Every month, £200 came out of my paycheque – no excuses, no distractions,” says Cameron.

In just under three years, the couple saved £27,740, including the government bonus from their LISAs. To reach the full deposit amount, they topped this up with an extra £4,260 from their personal savings.

But Cameron says the scheme hasn’t kept pace with rising prices.

“The £450,000 cap was set back in 2017 – it hasn’t moved. If your property is even £1 over that, you lose the bonus and get hit with a 25% penalty.”

Following calls from campaigners for the terms to be updated, the Treasury Committee is reviewing whether Lifetime ISAs are still fit for purpose.

Brian Byrnes, head of personal finance at Moneybox, a digital savings and investment platform, still thinks the scheme is a great option for first-time buyers.

“The Lifetime ISA works fantastically well for the vast majority of customers. Less than 1% are impacted by the £450,000 cap,” he says.

‘I used an income booster mortgage’

Abas Rai, 26, used a type of joint mortgage known as an “income booster mortgage” to buy his first home – a £207,000 two-bedroom house in Suffolk.

It’s a product offered by some lenders that lets a family member’s income be added to yours, even if they’re not living in the property, to increase how much you can borrow.

Even with a £30,000 deposit and a £33,000 salary, Abas struggled to get the loan he needed. To boost his affordability, he added his father, who earns £24,000, to the mortgage.

By combining their incomes, the bank was able to offer a bigger loan, though it meant his dad would also be liable if he defaults.

“The bank added our incomes together and then multiplied it by 4.5 – that’s how they worked out the affordability.”

But involving a parent comes with some challenges.

“Because the person added on to the mortgage is also added on to the property, one of the risks was my dad’s age – he’s 55 and coming to retirement soon, so I won’t be able to rely on his salary if I default on a payment.”

Abas plans to re-mortgage and remove his dad once his income increases, but says the scheme was worth it.

“If you’re not earning above, say £45,000, and you’ve got someone in the family, I would recommend you go for it.”

‘We moved 150 miles to a cheaper area’

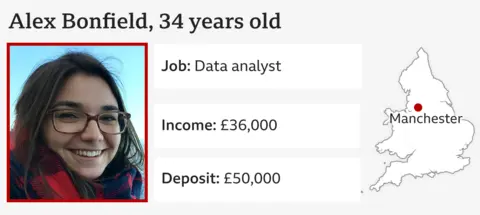

After years of renting in Oxfordshire, Alex Bonfield, 34, has relocated to Manchester to buy her first home.

“My wife is a teacher and she had to find an entirely new job up here. She really loved her old school, but this was more important,” she says. “It wasn’t an easy decision. We don’t know anyone here.”

The couple were priced out of buying near family and friends in Oxfordshire, where average house prices are £479,000, compared with £251,000 in Manchester.

They began saving five years ago, and are now house-hunting in the £300,000-325,000 range with a deposit of £50,000.

“We’re not at the very top of our affordability, but we are quite high up.”

They’re far from alone. According to Santander UK, 67% of first-time buyers over the past two years have relocated to get on the property ladder.

‘I went for shared ownership and a lodger’

Oliver Jones, 27, lives in London and used a shared ownership scheme to buy his first home – a two-bedroom flat worth £500,000. He bought a 25% share with a £40,000 deposit and sub-lets to a long-time friend whom he used to rent with.

“We were tired of doing that dance every year with the landlord trying to hike up rent by stupid amounts,” Oliver says. “Now we’re saving around £1,000 a month compared to our old flat.”

Shared ownership schemes let buyers purchase a portion of a property and pay rent on the rest. They’re often more accessible but come with complexities, like service charges and limited resale flexibility.

Oliver’s total monthly costs come to around £1,550, including £500 for the mortgage, £800 in rent on the 75% share he doesn’t own, and a £250 service charge. While he and his lodger informally split costs, Oliver covers all the housing payments.

“My mortgage rate is 5.4%, but the rent on the unowned portion is only about 2% of the property value.

“It’s cheaper to just own part of the property and pay rent than to buy the whole thing with a big mortgage.”

‘The Help to Buy ISA worked for me’

Daniel Price, 27, bought a three-bedroom home in the South Wales Valleys earlier this year, not far from where he grew up.

He started saving four and a half years ago using a Help to Buy ISA – a government scheme that topped up savings by 25%, up to a £3,000 maximum bonus. It has since been replaced by the Lifetime ISA scheme.

“Originally, my mum told me about it, so I just put a pound in to open the account,” he says.

“I paid in £200 a month and eventually saved £11,000, which got me a £2,500 government bonus.”

House prices in the South Wales Valleys tend to be lower than in many other parts of the UK, which can make home ownership there more achievable for first-time buyers.

Daniel bought his house for £95,000, below the asking price of £110,000, due to some minor renovations the property needed.

“A lot of houses were out of my price range as a single person, so I started looking further afield.”

“My dad found the house on Rightmove and showed me it. Everything was a bit outdated, but still liveable. It just needs a bit of work to modernise it.”

When he first applied for a mortgage in October 2024, Daniel was earning £18,000 a year while doing a software development apprenticeship. By the time the sale went through in January this year, his salary had risen to £24,000.

“I started saving when I was working in a factory as a warehouse manager. I then took up a tech apprenticeship and have just finished it. That helped with my affordability.”

‘I bought a fixer-upper’

Camilla De Cesare, 32, is a strategy consultant. She managed to buy her first home in London alone, but says it took seven years of living with her parents and being open to buying a property that needed some work.

“My family helped me with the deposit, and I had a stable job, so I was starting from a fortunate position,” she says.

Camilla saved and invested a total of £80,000 into the S&P 500, which tracks the performance of 500 leading companies listed on the US stock market. By steadily contributing over time and benefiting from market growth, her investment pot eventually grew to £150,000.

“I was really lucky that the S&P 500, was growing really well over the years that I was investing in it, so it provided me with a really healthy cushion.”

She spent £50,000 on her deposit, and the remaining £100,000 will go towards renovations on the property over the coming years, like a new kitchen and bathroom.

She says saving for a deposit felt more manageable knowing she could tackle renovations gradually, as and when she could afford them.

“I think when you first get the keys you just want to do it all at once. But there’s something satisfying about looking around and knowing you did some of it yourself.”

Tom Francis, head of digital advice at financial advisers Octopus Money, says most people would benefit more from “slow, steady saving”.

He encourages prospective buyers to break their spending into three buckets: essentials, desirables and indulgences.

“Think of your dream home as the destination – you can’t get there if you don’t know where you’re starting.”

Sarah Tucker, CEO of the financial advice firm The Mortgage Mum, urges younger people not to wait until they’ve saved for a deposit before seeking financial advice from mortgage brokers.

“There’s nothing better than speaking to a professional, even if you’re years away from buying.”