UK government finances better than expected in January

2 hours agoFaarea Masud

Getty Images

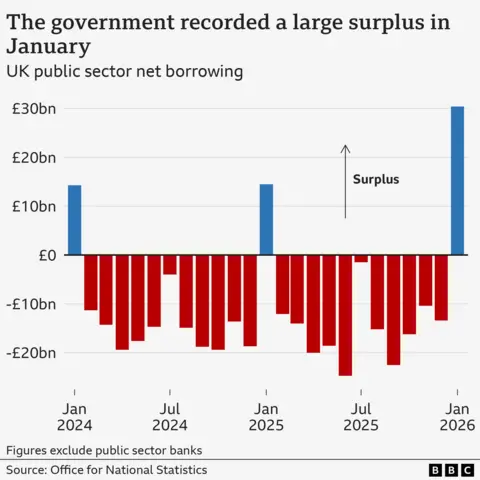

Getty ImagesThe government’s finances had a record monthly surplus in January as it took in more tax receipts than it spent.

The surplus – the difference between public spending and taxation – was £30.4bn in January, according to the Office for National Statistics (ONS). The figures come ahead of the Spring Statement on 3 March.

It was the highest surplus in any month since records began in 1993, without adjusting for inflation, and higher than last January’s £15.4bn surplus.

The government usually collects more tax than it spends in January compared with other months due to self-assessed tax payments falling in the month, but higher capital gains tax payments to HMRC pushed the figure to a record.

Analysts had

Borrowing in the 10 months to January was £112.1bn – 11.5% lower than the same 10 month period a year ago – although the ONS noted that it was the fifth-highest borrowing for the period on record.

HM Treasury said borrowing for 2026 is forecast to be “the lowest since before the pandemic.”

Chief Secretary to the Treasury, James Murray said: “We know there is more to do to stop one in every £10 the government spends going on debt interest, and we will more than halve borrowing by 2030-31 so that money can be spent on policing, schools and the NHS.”

Separately, retail sales grew more than expected in January, according to official data.

The amount of goods bought rose by 1.8% in January, up from 0.4% in December, the ONS reported.

City economists had expected a rise of 0.2%.

The performance was boosted by strong demand for sports supplements and jewellery. Sales of artwork and antiques also did well.

“The big reduction in public borrowing and surge in retail sales in January support other evidence that the economy started the year looking a lot healthier,” said Paul Dales, chief economist at Capital Economics.

He said it will give Chancellor Rachel Reeves “something positive to point to” in her Spring Statement.

Dales added that Reeves’ freeze on income tax thresholds took in an additional £3.6bn from a year ago, and a “£17bn surge” in capital gains tax receipts in January also buoyed the public finances.

The Treasury’s freeze on income tax thresholds is dragging people in to paying higher tax rates as their incomes rise.

Another thing that helped the government’s finances was that it spent less on interest payments on its debt, the ONS said – which offset higher costs on public service and benefits.

Taking a look at the whole year, Dales cautioned that the “that borrowing has failed to come down much”, and that much of the success in retail sales came from transient boosts such as sports supplements – which would fall back as people fell off the new year health kick.

He suggested part of the boost in retail spending was not sustainable, especially as recent figures showed that wage growth had slowed, and unemployment had reached its highest in five years.

Shadow Chancellor Mel Stride said Labour’s “record high taxes and irresponsible spending have weakened the economy”, with inflation still above target, a stagnant economy and that Labour had “no growth strategy”.

He added that national debt will “rise every single year” under Labour, along with the debt interest bill.

The ONS said in its release that the debt-to-GDP ratio, which measures public debt as a percentage of the size of the economy, was 92.9% at the end of January 2026 which it said “remains at levels last seen in the early 1960s”.