Who are the winners and losers from Rachel Reeves’ Budget?

50 minutes agoBen ChuPolicy and analysis correspondent, BBC Verify

Getty Images

Getty ImagesRachel Reeves has raised taxes again in her latest Budget. Though she conceded that “ordinary people” will contribute more in tax in the coming years, the chancellor has also argued it will require those with the “broadest shoulders” to pay more.

Ms Reeves has also stressed that other measures in the Budget – such as freezing rail fares in England and fuel duty across the UK and removing some costs from domestic electricity bills – will ease the cost of living squeeze for many families.

And the government estimates that the decision to scrap the two child limit on benefits will reduce relative child poverty by 450,000 by the end of the Parliament and raise average incomes in affected families by £5,310 a year.

So do these claims add up?

BBC Verify has examined what we know about how the Budget is likely to financially affect different groups.

What does it mean for you?

The impact of the Budget will depend on the individual characteristics of each household.

For instance, someone on a low income who does not have more than two children will not benefit from the scrapping of the two child benefit cap. And someone on a modest income who drives an electric vehicle would be hit by the new mileage charge for EVs.

Similarly, someone on a higher income who gets a lot of mileage out of their petrol car or uses a lot of energy at home could benefit more from the measures intended to help people with the high cost of living instead of people on lower incomes.

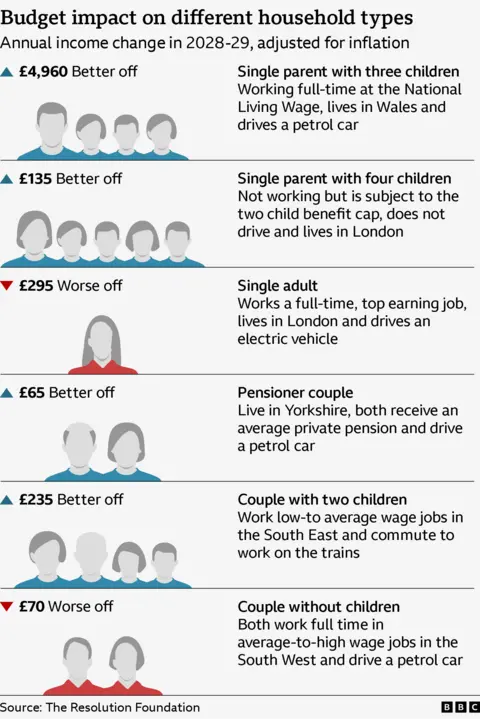

The Resolution Foundation think tank has produced some representative households to demonstrate these different effects:

It finds that, as a result of all the tax and benefit changes since the Autumn Budget in 2024, lower income households are more likely to benefit than to lose out financially, while for higher income households it’s the reverse.

It also finds that pensioner households are more likely to benefit from Reeves’ budget measures than working-age households, with 56% benefiting versus only 33% of families with children.

Do the wealthy bear more of the new tax burden?

Measures in the Budget such as the new high value council tax surcharge in England (set to raise £400m a year in 2029-30) and the increased income tax rates on property, savings and dividend income (set to raise £2.1bn a year) will predominantly fall on people with higher incomes since richer people tend to have more property wealth and more income from those sources.

The same is true of the plan to charge National Insurance on pension contributions made through workplace salary sacrifice schemes (set to raise £4.7bn).

The Treasury’s analysis suggests that by 2028-29 the tax measures in the Budget will reduce the incomes of the top 10% of earners in the UK population by around £2,000.

By contrast, the incomes of middle earners will be lower by around £300 and the incomes of the bottom 20% of earners will be some £200 lower.

Most earners will lose out because of the decision to extend the freeze in income tax thresholds by an additional three years from 2027-28. It drags more people – including those on relatively modest incomes – into paying more tax as their incomes rise with inflation.

Those currently earning below the personal allowance of £12,571 will find, as wages rise but thresholds don’t, they will pay tax for the first time. The Office for Budget Responsibility (OBR) estimates it could be as many as 780,000 more people paying tax by 2029-30.

Do the less well off benefit from other Budget measures?

The Treasury’s analysis also suggests that people on lower incomes will benefit much more than richer people from measures such as taking costs off electricity bills, freezing fuel duty and the scrapping of the two child limit, with the top 30% of earners seeing little cash gain.

The Institute for Fiscal Studies has put some of the main measures in the Budget together in its own analysis.

Those measures are:

- The freeze in personal tax thresholds

- The fuel duty freeze

- Scrapping the two child benefit limit

- The high value council tax surcharge in England

The think tank finds that by 2030-31 the net impact of these measures will be that the incomes of the lowest 20% of earners will be higher by between £220 and £290, whereas the incomes of the top 10% will be lower by around £700.

It’s worth bearing in mind, however, that these calculations only show the impact of the Budget measures.

Determining what actually happens to people’s incomes overall, wherever they are in the UK’s income distribution, will be how the wider economy performs.

And the downgrade in the OBR’s latest overall UK growth forecast means it also now projects average UK real household disposable incomes (RHDI) per person – the Government’s chosen target measure of living standards – to grow by just 0.5 per cent a year on average by the end of the Parliament.

According to the Resolution Foundation, that would mean average income growth of just £740 (in 2025-26 money) over the Parliament, which would make this the second worst Parliament for income growth on record.

Additional reporting by Phil Leake